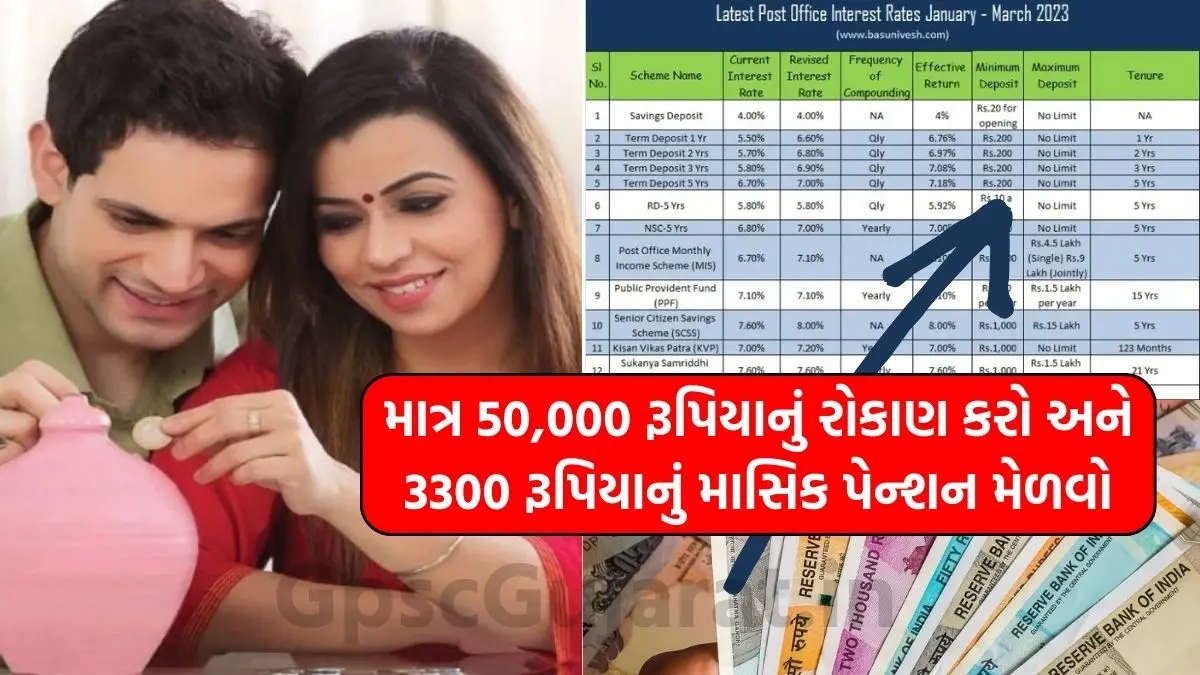

Aaj ke time me retirement ke liye secure pension plan hona bahut zaruri hai. Agar aap chahte hain ki ek chhote investment se aapko life-long monthly pension mile, to government aur financial institutions ne kuch aise pension schemes launch kiye hain jisme aap sirf ₹50,000 invest karke ₹3,300 per month pension le sakte hain.

Yeh scheme un logon ke liye best hai jo ek bar ka investment karke retirement ke baad stable monthly income chahte hain.

🔹 Scheme Highlights

- Investment Amount: ₹50,000 (one-time)

- Monthly Pension: ₹3,300 tak

- Annual Income: ₹39,600 tak

- Type of Scheme: Government-backed pension plan / LIC pension plan

- Beneficiaries: 18+ saal ke nagrik jo retirement ke liye savings karna chahte hain

🔹 Benefits of This Pension Scheme

- Low Investment, High Returns – Sirf ₹50,000 se stable pension milti hai.

- Guaranteed Monthly Income – Retirement ke baad financial security ke liye.

- Government Support – Scheme ko government/LIC jaisi trusted institutions manage karti hain.

- Lifetime Pension – Regular monthly pension ka benefit life-long.

- Tax Benefits – Income Tax Act ke under kuch deductions available.

🔹 Eligibility Criteria

- Applicant Indian citizen hona chahiye.

- Minimum age: 18 years

- Maximum age: 60 years (scheme ke rules ke according alag ho sakta hai)

- Applicant ke paas valid Aadhaar card aur bank account hona chahiye.

🔹 Documents Required

- Aadhaar Card

- Age Proof (Birth Certificate/School Leaving)

- PAN Card

- Bank Account Details (Passbook copy)

- Passport-size Photos

- Mobile Number

🔹 How to Apply for Pension Scheme

- Official website (LIC / PFRDA / Govt portal) par visit karein.

- Pension scheme option select karein.

- Online registration form fill karein.

- Required documents upload karein.

- Investment amount deposit karein.

- Successful registration ke baad pension plan activate ho jayega.

🔹 Monthly Pension Calculation Example

- Investment = ₹50,000 (one-time)

- Monthly Pension = ₹3,300 (approx.)

- Annual Pension = ₹39,600

- 10 Years Pension = ₹3,96,000 (approx.)

Is tarah ek chhoti si investment aapke liye long-term financial security create karti hai.

❓ FAQs – Pension Scheme with ₹50,000 Investment

Q1. Kya sach me ₹50,000 invest karke ₹3,300 pension mil sakta hai?

👉 Haan, kuch government aur LIC-backed schemes me aapko itna pension milta hai.

Q2. Pension kab se start hoti hai?

👉 Pension retirement ke baad ya scheme ke rules ke hisaab se start hoti hai.

Q3. Kya pension life-long milegi?

👉 Haan, life-long pension benefit hota hai (terms & conditions ke saath).

Q4. Kya scheme me tax benefit bhi milta hai?

👉 Haan, Income Tax ke Section 80C ke under deduction claim kar sakte hain.

Q5. Kya main online apply kar sakta hoon?

👉 Haan, LIC aur government portals par online application option available hai.

📌 Conclusion

Agar aap apne retirement ko secure banana chahte hain to ₹50,000 invest karke ₹3,300 monthly pension lena ek best option hai. Is tarah ke pension plans middle-class families ke liye banaye gaye hain jisme low investment se high monthly return milta hai.

Important Links

| Official website | View Here |